Saving for Retirement (captioned)

in Plain English

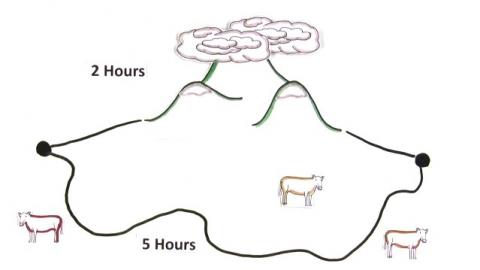

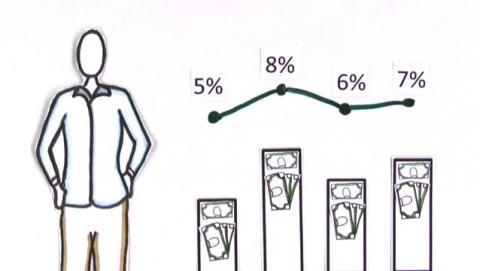

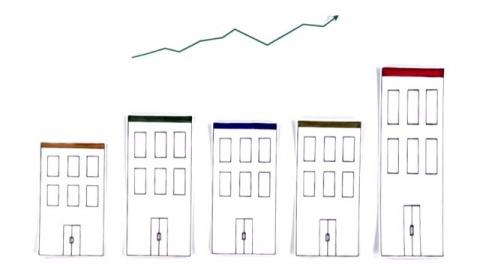

This video is designed to teach the benefits of using a retirement account for financing a comfortable retirement.

Explain Your Ideas with Cut-outs

Make your next creative project remarkable using our library of 3,388 original, matching visuals.

Download high resolution images to your computer and use them in presentations, documents, training materials, videos and more.

"I use Common Craft Cut-outs to explain complex concepts and brighten presentations at our company."

- Julie Rieken, CEO, Trakstar and Reviewsnap

Develop powerful explanation skills. Learn to create animated explainer videos.

Join Common Craft founder Lee LeFever in online, self-paced courses at the Explainer Academy.

"In a word, the Explainer Academy was delightful, very well executed, and very practical."

- Bill Welter, President, Adaptive Strategies

Find the Right Plan for You

Never Miss a New Video

Join the 12,000+ subscribers who get our monthly newsletter with new videos, discounts, and free resources.